will capital gains tax increase in 2021 uk

13 2021 and will also apply to Qualified Dividends. Because the combined amount of 20300 is less than 37500 the basic rate band for the 2020 to 2021 tax year you pay Capital Gains Tax at 10.

What the property tax rate is.

. For those who pay a higher rate of income tax or a trustee or business the rate is currently 28 per cent on gains from residential property and 20 per cent on gains from other chargeable assets. Inheritance tax and capital gains tax for ATX-UK. This means youll pay.

The tax increases are proposed for the 2022 tax year and there are many significant changes to the tax code that might occur that you need to know. The increase would be substantially bigger from 20 to 45 therefore it would be good to know if this does take place should assets be sold off before the end of this tax year. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely.

Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four. CGT is a tax on the profit when you sell an asset that has increased in value. RISHI SUNAK has been urged not to raise capital gains tax for the wealthy as the UK economy looks to recover from the pandemic.

Capital gains tax CGT breakdown. Or could the tax rate be retroactively applied to the 202122 tax year. Once again no change to CGT rates was announced which actually came as no surprise.

Capital tax on securities will hamper liquidity euroclear says. Basic rate taxpayers would face an increase of 10 to 20 capital gains tax or higher rates on large gains treated as. In particular continued talk of a capital gains tax CGT reform in the UK has been widespread and resounding for some time.

Surcharge on long term capital gains capped at 15 percent. Previously there had been a window of just 30 days for taxpayers to report the gain and pay the tax owed as of the Budget on 27 October 2021 this was immediately increased to 60 days. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for more than a year.

Resident for tax purposes on H1B visa. Taxes united-kingdom capital-gains-tax capital-gain. Will Capital Gains Tax Increase In The March 2021 Budget.

Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. The tables below show marginal tax rates. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase.

Accordingly the increase in value of the shares since the date of purchase will not be subject to CGT. However some experts say that CGT does not make up a significant portion of the UK tax revenue so an increase wouldnt be nearly enough compared to. This new rate will be effective for sales that occur on or after Sept.

If the tax rate is 10 investors will pay this fee while investors will pay 20. The maximum capital gains are taxed would also increase from 20 to 25. Capital Gains Tax 2022 Uk - Capital Gains Tax Rate 2022 - It is commonly accepted that capital gains are gains made through the sale assets such as stock real estate a property or a company and these earnings are taxable income.

UK government shelves proposals to increase Capital Gains Tax rate by. Its the gain you make thats taxed not the. For example a single.

Capital Gains Tax 2022 Uk - Capital Gains Tax Rate 2022 - It is commonly accepted that capital gains are gains made through the sale assets such as stock real estate a property or a company and these earnings are taxable income. 13 2021 and will also apply to Qualified Dividends. In the wake of the unprecedented but necessary public spending throughout the pandemic the Treasury will certainly need to find ways to reduce the deficit and rebalance the UKs finances.

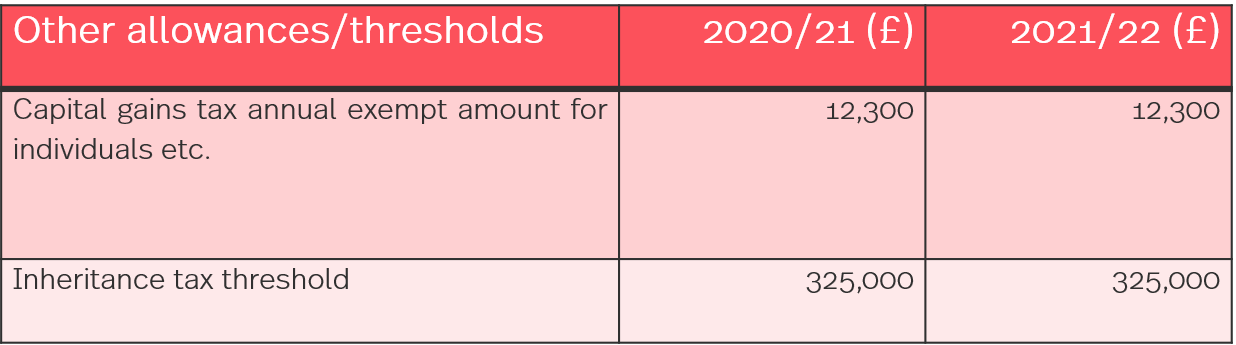

This means that different portions of your taxable income may be taxed at different rates. What Are the Capital Gains Tax Rates for 2021 vs. The Annual Exemption For 20212022 Will Remain At 12300 And The Chancellor Announced That The Annual Exemption Will Remain At This Amount For The Tax Years 202122 To 202526.

Strict restrictions for unvaccinated come into effect in Greece. There is a capital gains tax allowance that for 2020-21 is 12300 -. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers a rise of 25 for a higher and additional rate taxpayers.

Will capital gains tax increase at Budget 2021. Capital Gains Tax Calculator 2021-2022. By Charlie Bradley 1347 Sat May 15 2021 UPDATED.

Capital gains tax reporting extended Another announcement in the Autumn Budget 2021 affects anyone who makes a capital gain after selling a property. For the 2020 to 2021 tax year the allowance is 12300 which leaves 300 to pay tax on. UK records 44917 new cases.

Budget 2022 Uk Capital Gains. For those on basic rate income tax the rate will depend on the size of the gain taxable income. A property sell gives you an upside gain and when you sell it you are liable to pay 18 capital gains tax CGT in the standard category or 28 if you were in higher tax brackets.

This new rate will be effective for sales that occur on or after Sept. Taxes on capital gains in 2021-22 and 2020-21 will be adjusted according to inflation. 2021 federal capital gains tax rates.

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

What Is Capital Gains Tax And When Are You Exempt Thestreet

How Much Is Capital Gains Tax Times Money Mentor

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Accotax Accountants In 2021 Accounting Accounting Services London

Difference Between Income Tax And Capital Gains Tax Difference Between

Capital Gains Tax On Sale Of Property I Tees Law

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

Difference Between Income Tax And Capital Gains Tax Difference Between

Capital Gains On Home Sales What Is Capital Gains Tax On Real Estate Guaranteed Rate

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Tax On Separation Low Incomes Tax Reform Group

North West Led Annual House Price Growth In England During 2020 Https Www Buyassociation Co Uk 2021 02 19 North West Le In 2021 For Sale Sign House Prices North West

How To Reduce Your Capital Gains Tax Bill Vanguard Uk Investor

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)