2021 ev tax credit rules

Qualifying vehicles manufactured by that manufacturer are eligible for 50 percent of the credit if acquired in the first two quarters of the phase-out period and 25 percent of the. The Internal Revenue Service IRS and US.

New Ev Tax Credits Raise Fear Of A Messy Scenario For Car Dealers Automotive News

Since the US added EV tax.

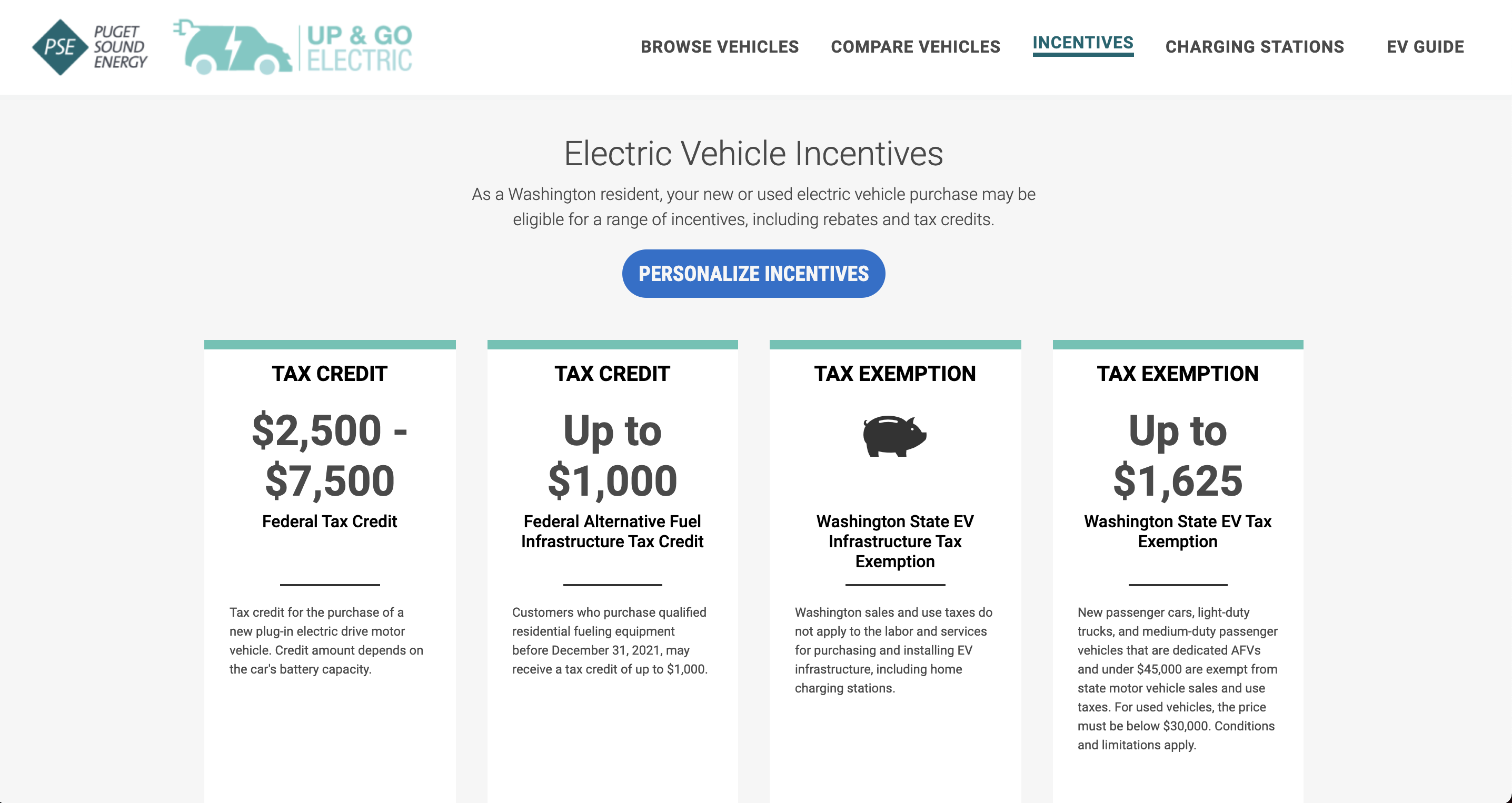

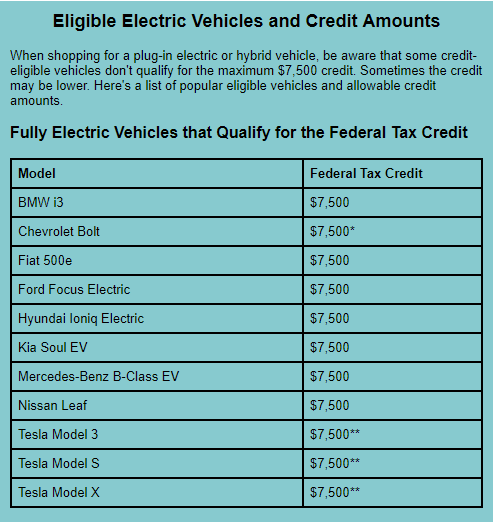

. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. This nonrefundable credit is. New Rules 2022 Beyond For Electric Vehicle EV Tax Credits.

Used EVs will get a tax credit. The IRS tax credit for 2022 ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Stephen Edelstein October 6 2022 Comment Now.

How much is the new EV tax credit. The rules for used EVs also take effect on January 1 2023 and are. Treasury Department are seeking public comment on draft rules for the revised.

On January 1st used EVs priced 25000 or less will be eligible for a 4000 tax credit or 30 of the sales price whichever is lower. US congressional leaders have agreed to a bill that would expand the existing 7500 new EV tax credit while introducing the first federal tax credit for used EVs. The credit for automobiles obtained after.

The new credits will be 7500 for new vehicles and 4000 for used vehicles and will apply to the purchase of EVs plug-in hybrids. 421 rows Federal Tax Credit Up To 7500. Eligible vehicles such as EVs can qualify for up to 7500.

Beginning on January 1 2022. The EV tax credit is currently a nonrefundable credit so the government does not cut you a check for the balance. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US.

The exceptions are Tesla and General Motors whose. Section 30D of the Internal Revenue Code offers a credit for Qualified Plug-in Electric Drive Motor Vehicles such as passenger cars and light trucks. The new tax credits replace the old incentive.

The tax credit for used EVs will be calculated at either 30 of the vehicles value or 4000 whichever is less. The exact amount varies depending on the vehicles battery capacity but electric vehicles have historically qualified for. Simply put the Inflation Reduction Act includes a 7500 tax credit at the point of sale for new EVs and 4000 for used EVs.

The new IRA of 2022 bill also allows for an EV tax credit. Non-cars vans trucks SUVs need to be under 80000 to be. A Congressional Budget Office analysis shows that the bill budgets for 85 million in new EV tax credits for the 2023 fiscal year which only translates to about 11000 new.

Written by Diane Kennedy CPA on August 29 2022.

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green Pkf Mueller

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Ev Tax Credits Will Be Back For Popular Brands If Law Passes

How To Get Illinois 4 000 Electric Vehicle Rebate Wbez Chicago

Get A Tax Credit For Buying An Electric Vehicle Updated List 2023

Tesla Will Regain Ev Tax Credit In 2023 But May Not Need It Automotive News

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Democrats Push Forward With Ev Tax Credits Roll Call

Us Senate Deal To Expand Ev Tax Credits Income Caps Price Caps

U S Democrats Plan Boosts Ev Tax Credit Eligibility To Pricier Trucks Suvs Reuters

Impact Of Proposed Changes To The Federal Ev Tax Credit Part 1 Summary Chart Evadoption

When Will The 12 500 Ev Tax Credit Be Approved And Sent As Usa

Biden Proposal For Electric Vehicle Tax Credits Irks Canada And Mexico The San Diego Union Tribune

Fixing The Federal Ev Tax Credit Flaws Redesigning The Vehicle Credit Formula Evadoption

Which Electric Cars Are Still Eligible For The 7 500 Federal Tax Credit News Cars Com

Why The New Federal Tax Credit Rules May Just Kill The Ev Incentive For Good